The Green Sheet Online Edition

February 2, 2025 • 25:02:02

Why reviewing non-compete and non-solicit laws is essential

Non-compete and non-solicit agreements are legal tools businesses use to protect their interests by limiting certain activities of employees, independent contractors or business partners during and after their relationship with the company.

While they share a common goal of safeguarding business assets, their focus and scope differ:

- Non-compete agreements: These agreements restrict an individual from working for competitors or starting a competing business within a specific geographic area and timeframe. They are typically used to protect trade secrets, proprietary information and client relationships from being leveraged against the business.

- Non-solicit agreements: These agreements prevent individuals from soliciting a company's employees or customers for their own benefit or the benefit of another organization. Non-solicits typically come in two primary forms.

- Employee non-solicits: Prohibit the solicitation or recruitment of a company's employees.

- Customer non-solicits: Restrict the solicitation of a company's clients or customers to divert business.

Key differences between the two

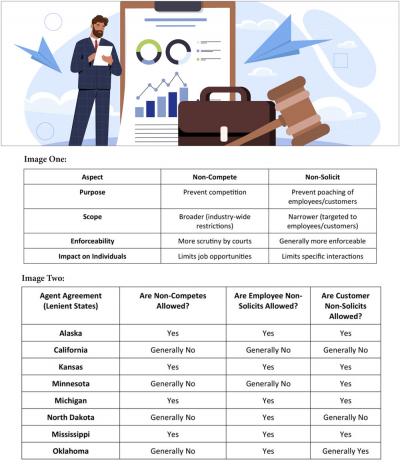

The following illustrates the distinctions between non-complete and non-solicit agreements:

(See Image One for details)

While non-compete agreements are often seen as more restrictive and face greater legal challenges, non-solicit agreements are generally more acceptable to courts because they are perceived as less intrusive to an individual's ability to earn a livelihood.

Variability across states: a snapshot

State laws governing non-compete and non-solicit agreements range widely across the United States. Some states impose minimal restrictions, allowing these agreements to be broadly enforceable under reasonable conditions, while others impose strict limitations or outright bans.

(See Image Two for details)

For companies operating in the electronic payments industry, understanding these differences is critical to ensure enforceable and compliant agreements. The following shows differing policies among several states: This analysis reveals that even within the same state, specific rules may differ between non-competes and employee and customer non-solicits.

Implications for the Electronic Payments Industry

Following are four implications to be aware of for the electronic payments industry:

- Tailored agreements: Businesses should customize non-compete and non-solicit agreements to align with state-specific requirements. A one-size-fits-all approach can result in unenforceable clauses.

- Strategic planning: Companies operating across multiple states must factor in the legal enforceability of these provisions during their hiring, agent contracting and client onboarding processes.

- Legal consultation: Given the rapid changes in non-compete and non-solicit laws, consulting with experienced legal counsel ensures compliance and minimizes risk.

- Alternative protections: In states with strict restrictions or bans, businesses can explore other methods to protect their interests, such as confidentiality agreements or trade secret protections.

Understanding and adhering to state-specific non-compete and non-solicit laws is essential for businesses in the electronic payments industry. By staying informed and proactive, companies can protect their assets while fostering compliance with the law. Whether operating in lenient states like Alaska or restrictive environments like California, businesses must prioritize thorough legal reviews and strategic contract drafting to thrive in a competitive market.

Note: This article is for informational purposes only and does not constitute legal advice. The information provided may not reflect the most current legal developments and may be incomplete or inaccurate. Readers should consult a qualified attorney to obtain legal advice specific to their circumstances.

An alumnus of the University of San Diego, School of Law, Arzumanyan has a proven track record of drafting, reviewing, revising and negotiating an extensive array of commercial contracts, including vendor, nondisclosure, employment, software-as-a-service, consulting and marketing agreements. Leveraging his prior in-house counsel background, Arzumanyan has also carved out a unique niche within the electronic payments industry as his transactional expertise now encompasses merchant processing, merchant banking and sponsorship, referral, independent sales office, and other related agency agreements. Contact him at larzumanyan@glrlegal.com.

Notice to readers: These are archived articles. Contact information, links and other details may be out of date. We regret any inconvenience.